Urban Maintenance Business

In the past, association method maintenance

Business relying on constructors had various difficulties such as

project expense securing problem because of insufficient

expertise, share allotment of land owners, conflicts between

associations and constructors and various corruptions and

irregularities. To resolve these problems and to achieve

efficient urban regeneration, in March 2016, city and residential environment maintenance law

was revised and trust method maintenance

Business was introduced.

Through this, slow maintenance Business sites accelerated

development and project efficiency was enhanced, and it is fast

spreading to the entire nation through Seoul, Yeouido, and

Gangnam.

Korea's first trust method reconstruction

project order

obtainment and construction

beginning

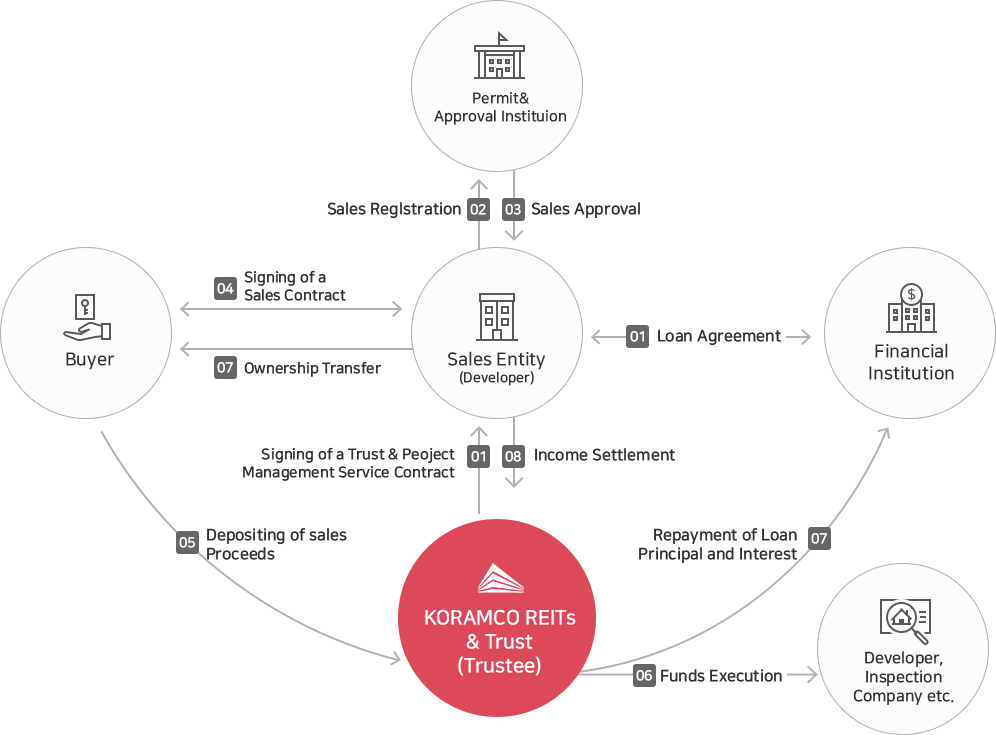

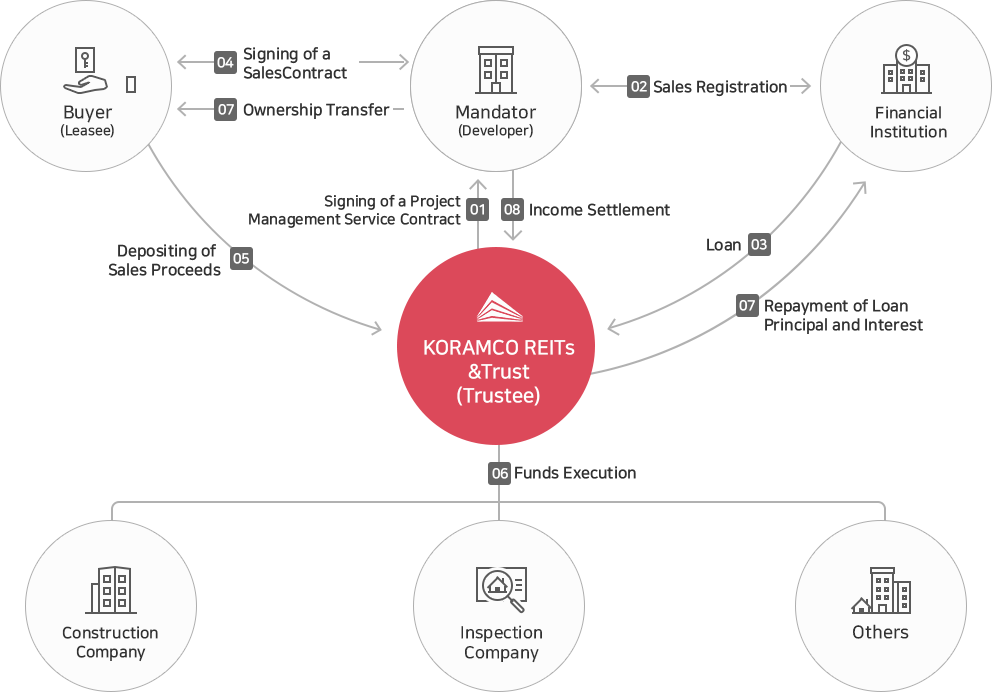

KORAMCO REITs & Trust implements

reconstruction projects' developmentㆍmanagementㆍoperation

businesses in place for reconstruction association based on

systematic legalㆍtechnologyㆍsales capability and capital. In

particular, it has urban maintenance Business headquarters

specialized in urban maintenance and two maintenance Business

teams under the headquarters, and in Devember 2015 obtained house

reconstruction projects in Anyang and Hogye, the business proxy

method house reconstruction projects for the first time as a

trust company.House reconstruction projects in Anyang and Hogye

were successfully completed with contracts of association members

and the general public, through specialized construction

management, it will be completed and residents will move in in

2019. As of the first quarter in 2018, KORAMCO asset in trust has

the only experience of constructing trust type reconstruction

projects, and it has become the best partner by expanding order

obtainment not only through participation in the form of project

proxy but also in the unilateral implementaion form.

- Project Overview : house reconstruction project in

Anyang Hogye dong (Hogye Daesunguneed)

- Size : 2 floors under the ground~27 floors on the

ground, a total of 203 households

- Location : Anyang city Dongangu Hogyedong 891-6 area