Offering differentiated service and new

project composition KORAMCO grows into a leading trust company

through differentiated service than rival companies and offering

of new project composition despite the fact that it is a late

mover which entered real estate trust business in 2006.

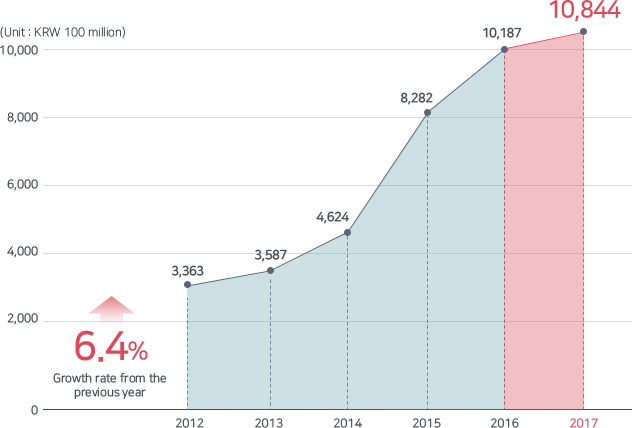

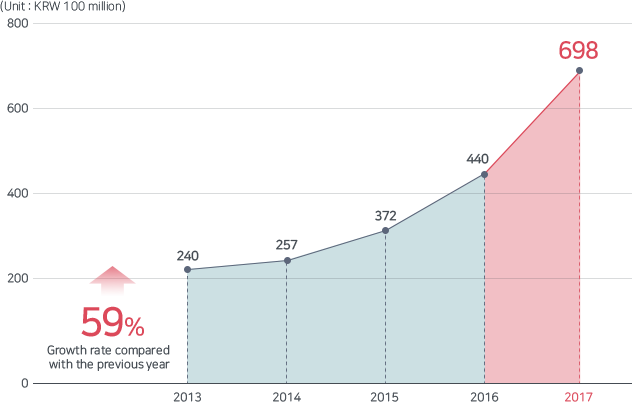

Last year KORAMCO earned new contracts of KRW 73.1 billion

created operating profit of KRW 69.8 billion.

This

results reflect the risk management through thorough project

analysis and legal and technology business strengthening.

KORAMCO renewed maximum operating profit every years and it will

do its best for sustained growth.

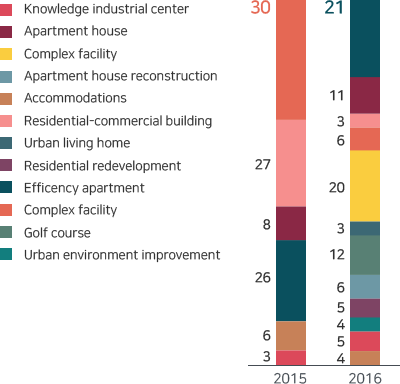

For the first time as a trust company,

entering house reconstruction business and stable implementation

KORAMCO is implementing developmentㆍmanagementㆍoperation

businesses of reconstruction business in place of reconstruction

association based on systematic legalㆍtechnologyㆍsales capability

and capital.

In particular, it has urban maintenance

project headquarters specialized in urban maintenance and two

maintenance project teams under the headquarters, and obtained

house reconstruction projects in Anyang Hogye, the business proxy

method house reconstruction projects for the first time as a

trust company.

Business site in Hogyedong saw successful

sale contracts of association members and general public, and the

construction was smoothly processed and expected to be comleted

in spring on 2019.

KORAMCO is a trust company which has

Korea's first trust method maintenance project implementation

experience, and it is expected to be the best partner by

expanding the service areas not only through business proxy

method but also through unilateral implementaion method.