Through 33 new REITs approved in 2017, there are a total

of 192 REITs operated in Korea.

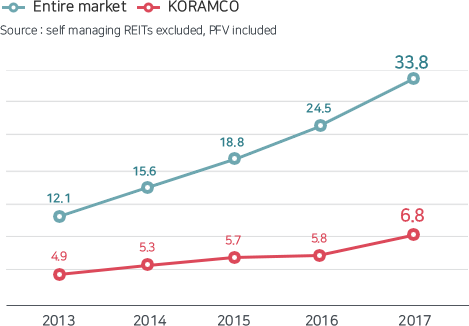

Total asset size increased by about 35% compared with the previous year at around 3.38 trillion won.

In addition, revision of real estate law permitting both REITs and real estate fund simultaneously and the governments

REITs strengthening policy, asset operating company, financial holding company, and developers actively enter REITs AMC.

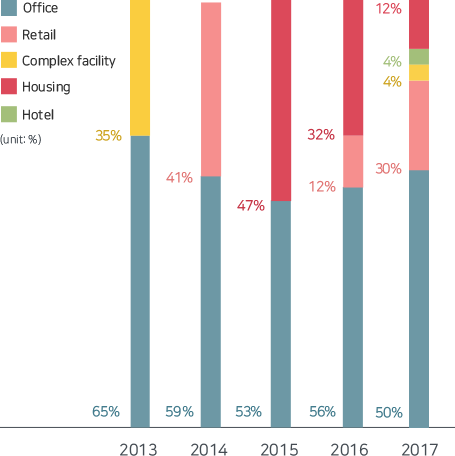

Accordingly, the competition in the REITs market intensifies, and product diversification and quality growth are required.

KORAMCO REITs & Trust is the leader in REITs business, steady expansion of market share through competitive edge enhancement and product differentiation are realized and efforts to expand indirect investment for quality growth of REITs market and general investors are made.